Calculate Intrinsic Value of Stock Online

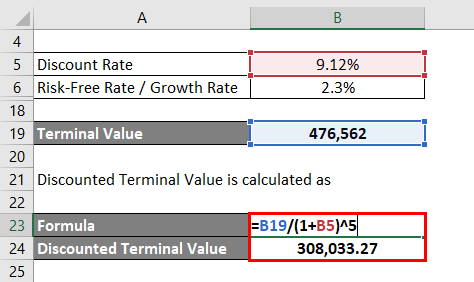

Stock Rover has the following Beta Calculation. After calculating the present value of future cash flows in the initial 10-year period we need to calculate the Terminal Value which accounts for.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

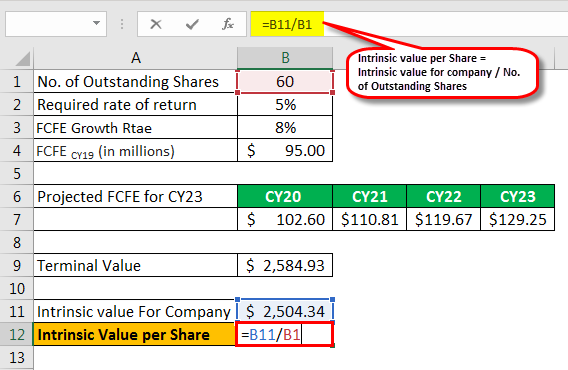

More the growth More will be the Intrinsic Value.

. The most common splits are 2-for-1 or 3-for-1. So with the help of this value an investor can get the information about how rationally his stocks are priced. Intrinsic value is an estimate of the actual true value of a company regardless of market value.

Future stock the future value calculator of stocks 7. Finding value stocks how to find stock value 6. Margin of Safety is the Percent you deduct from the Intrinsic Value to have a.

Real value of stock and how to calculate 4. Type in the current AAA corporate bond yieldThe current AAA corporate bond yields in the United States are about 422. Market value is the current value of a company as.

The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of. Unlike relative forms of valuation that look at comparable companies intrinsic valuation looks only at the inherent value of a business on its own. An employee stock option ESO is a stock option granted to specified employees of a company.

The Enterprise Value or EV for short is a measure of a companys total value often used as a more comprehensive alternative to equity market capitalization. Theres more than one way to determine the value of an investment. This gives you the fair value price you should pay for a stock.

An analyst placing a value on a company looks at the company. Active investors calculate a series of metrics to estimate a stocks intrinsic value and then compare that value to the stocks current market price. Enterprise Value EV.

Typically when calculating a stocks intrinsic value investors can determine an appropriate margin of safety wherein the market price is below the estimated intrinsic value. Finally you can now find the value of the intrinsic price of the stock. Enter the earnings per share of the company.

Valuation is the process of determining the current worth of an asset or a company. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 16. In cell B2 enter B4B6-B5 The current intrinsic value of the stock ABC in this example is 398 per share.

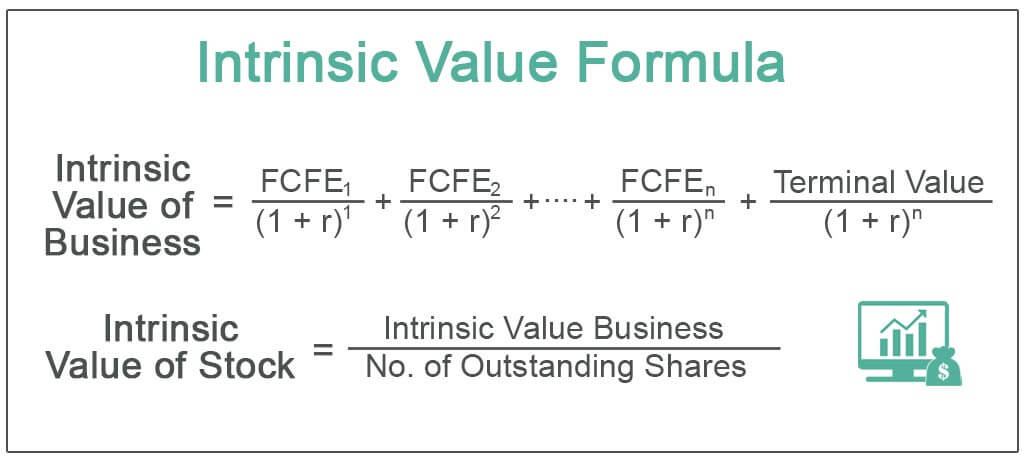

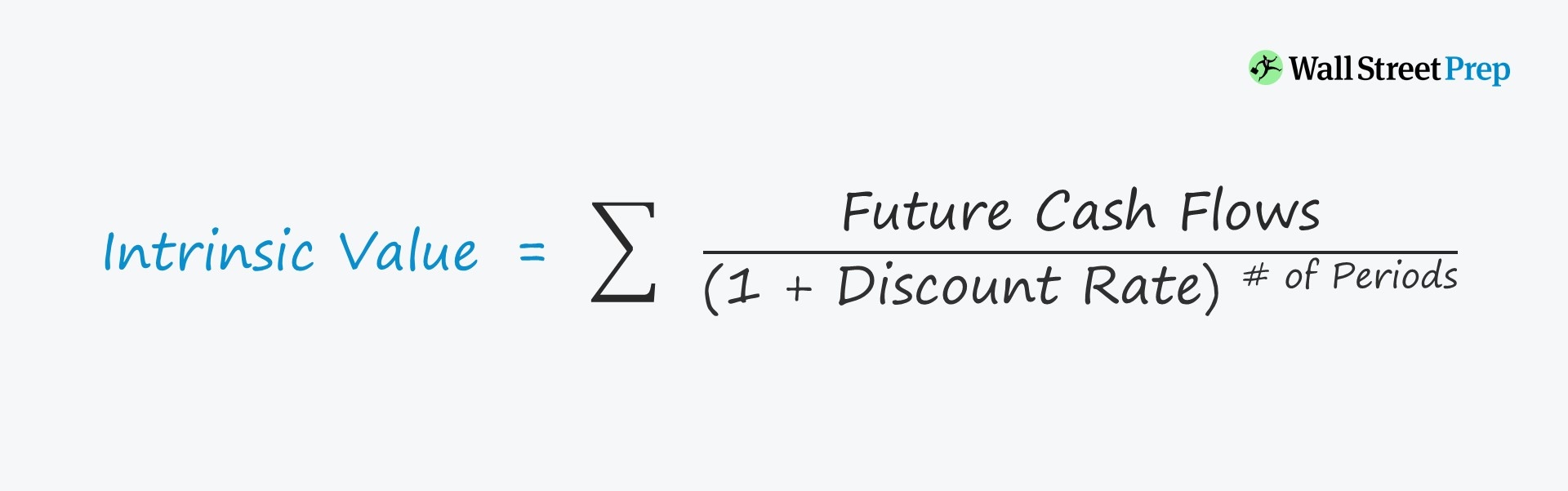

To calculate the intrinsic value of a stock you estimate a companys future cash flow discount it by the compounded inflationinterest rate and divide the result by the number of shares outstanding. Pe ratio calculator how to calculate price earnings ratio 8. Download a free Benjamin Graham formula valuation spreadsheet so you can calculate a stocks intrinsic value the Ben Graham way and easily customize it.

Relative to the current share price of UK63 the. Using a stock screener with powerful financial analysis is the easiest way to calculate complex financial ratios like Beta. In this article Ive applied Benjamin Grahams formula to a free Graham Formula spreadsheet that will allow you to quickly value the intrinsic value of a company the Benjamin Graham way.

To get the intrinsic value per share we divide this by the total number of shares outstanding. As market value contains a number of other factors in calculation of assets value intrinsic value tells us the pure value of a stock. This is the intrinsic value estimate per share for Indian Tobacco Company at the time of writing using the DCF model Dec 2021.

ESOs offer the options holder the right to buy a certain amount of. After placing the above values in the DCF Calculator the true intrinsic value per share of ITC turns out to be Rs 21480 after a margin of safety of 20 on the final intrinsic price. Analysis based on a financial metric.

A quick and easy way of determining the intrinsic value of a stock is to use a financial metric such as the price-to-earnings PE ratio. Enter the current market price of the share. Employee Stock Option - ESO.

The intrinsic value of a business or any investment security is the present value of all expected future cash flows discounted at the appropriate discount rate. A stock with EPS 50 and Growth Rate 20 will be having an Intrinsic Value of Rs. Let us see how to calculate the intrinsic value of a stock using our online intrinsic value calculator.

Intrinsic Value meaning is the Real Value of the company based on its EPS Growth Rate. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. A particular method to calculate and to determine this value consists of two steps.

Stock Rover our review-winning stock research and analysis screener makes calculating Beta easy. Intrinsic value calculator online 5. Beta 1-Year Beta 3-Year.

There are many techniques used to determine value. We provide assignment help in over 80 subjects. Markets for instance let you know what investors are willing to pay right now for shares of stock or a companys bonds.

N Period which takes values from 0 to the nth period till the cash flows ending period C n Coupon payment in the nth period. Input the expected annual growth rate of the company. Online stock value estimator how to estimate the real value of stock 9.

We are a leading online assignment help service provider. The total dollar value of the shares remains the same because the split doesnt add real value. YTM interest rate or required yield P Par Value of the bond Examples of Bond Pricing Formula With Excel Template Lets take an example to understand the calculation of Bond Pricing in a better manner.

The Easy Way to Calculate Beta.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Valuation Method Overview And Pros Cons

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

0 Response to "Calculate Intrinsic Value of Stock Online"

Post a Comment